Post Judgment Costs and Interest

How do I Compute 10% Interest That I’m Entitled to on a Judgment?

Judgment Calculator Below

Interest begins on the day the final judgment is entered. If partial payments are made, those payments are first applied to the accrued interest and then to the unpaid principal.

For more information, check out California Code of Civil Procedure §§685.010 to 685.030. To calculate the interest, first determine the daily amount of interest. For example, a $5,000 judgment will accrue $500 of interest per year at a rate of 10%. Dividing $500 by 365 days gives you a daily interest rate of $1.37.

Now, assume that after 145 days the debtor pays you $400. The following computation shows the amount of interest that will accrue after that payment is made:

After 145 days, $198.65 (145 days x $1.37/day) of interest will have accrued on the $5,000 judgment. Out of the debtor’s $400 payment, pay yourself the accrued interest first. You then will have $201.35 left ($400 – $198.65 = $201.35). Now credit the remaining $201.35 against the $5,000 judgment ($5,000 – $201.35 = $4,798.65 of unpaidprincipal). The new daily interest will then accrue at a rate of $1.31/day ($4,798.65 x 10% = $479.86 ÷ 365).

How To Find A Process Server For Nelson and Kennard in California

Serve Now How To Find A Process Server For Nelson and Kennard in California?

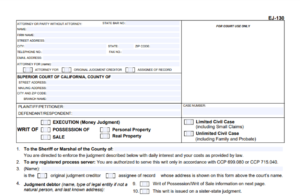

How To Fill Out A Writ of Execution in California

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on pinterest Pinterest Share on reddit Reddit Share on tumblr Tumblr Share

How To Select A Small Claims Court Sacramento Process Server Near Me

Sacramento small claim court legal matters are serious business and should be handled as such. Therefore, if you need to serve legal process, then you

How To Save $25 On Process Service Fees from Carol Miller Justice Center & William R. Ridgeway Family Relations Courthouse

How To Save $25 On Process Service Fees from Carol Miller Justice Center & William R. Ridgeway Family Relations Courthouse

How Much Does Small Claims Court Cost?

How Much Does Small Claims Court Cost? There are numerous fees that have to be paid when you are a filing your small claims case

How To Sue Audi of America In Small Claims Court California?

My name is Lance Casey and I am a Process Server in Sacramento California. I was recently hired to serve Audi of North America, Inc